Main Items:

- There were further headlines suggesting that a Greek PSI deal is imminent.

- US 4Q GDP improved to 2.8% QoQ in 4Q vs 3.0% exp and 1.8%.

- Personal consumption was weak at 2.0% vs 2.4% exp and 1.7% prev. eased by 2.8%,

- Most of the gains were in inventories (1.9%)

Overseas:

- Swiss KOF LEI declined to -0.17 in Jan vs -0.10 exp and 0.01 prev. This is the first negative reading since 2009.

- Spanish Unemployment increased to 22.9% in Q4 vs 22.2% exp and 21.5% prev. The participation rate declined 20bps to 59.9%

- South Korea Manufacturing Survey improved to 81 in Feb vs 79 prev

- Japan CPI improved to -0.1% YoY in Dec as exp vs -0.2% prev

Commentary:

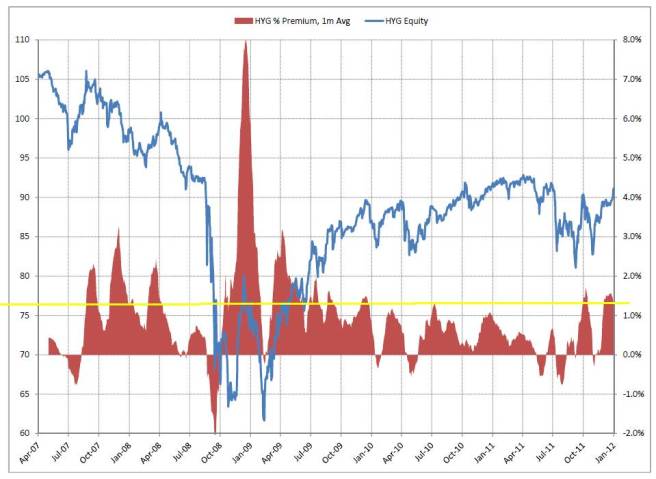

High Yield bonds may be overbought. This is on the back of massive new inflows into the space, as reflected by the surge in new shares created in HY ETF’s. The HYG ETF has traded at a premium of over 1% above NAV for the past couple weeks, a phenomenon which has historically coincided with corrections.

Separately, EURSEK has had a nice 6% peak to trough sell off since early Dec, but with the recent developments in economic data and price action, it may be time to take profits and wait for better levels.